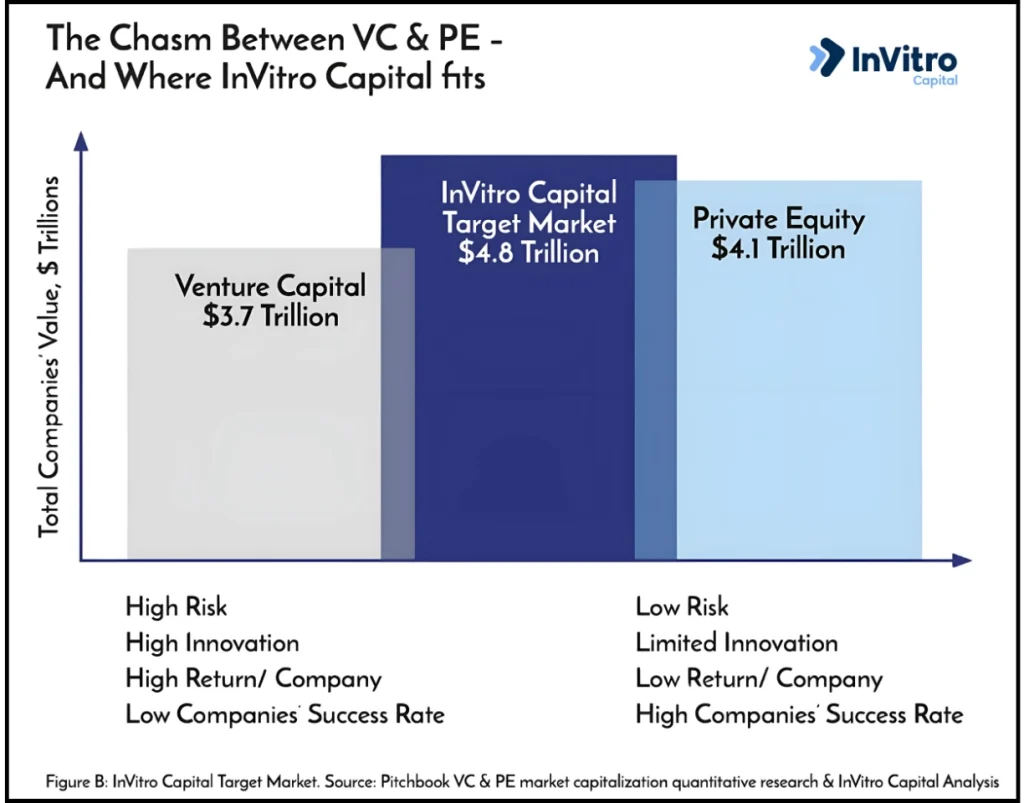

The private markets landscape is undergoing a remarkable transformation. With over $13 trillion in AUM as of 2022, alternative investments have become essential components of sophisticated portfolios. For family offices seeking both wealth preservation and growth, venture builders represent a compelling solution, offering strategic advantages in accessing high-growth potential with significantly mitigated risk.

The Private Market Evolution Private equity and venture capital have long been staples in diversified portfolios, providing access to innovation and potentially outsized returns. However, these traditional models come with inherent limitations:

- Venture Capital: High failure rates with less than half of startups reaching Series A funding, creating significant portfolio volatility.

- Private Equity: Targeting mature businesses through buyouts and operational improvements, but often lacking the innovation upside of earlier-stage investments.

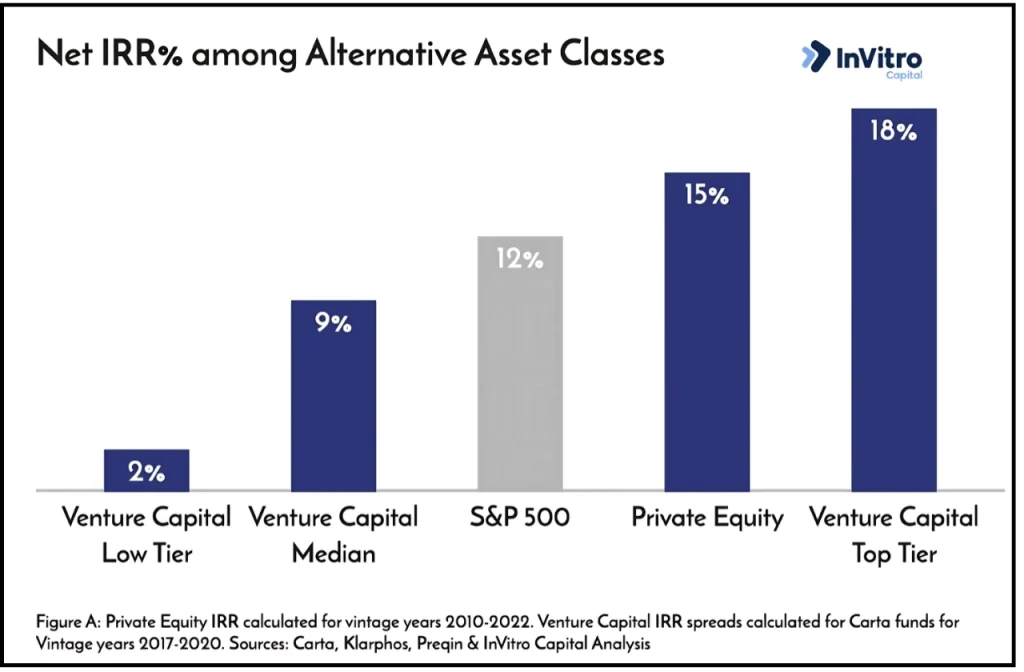

Comparing the Net IRR of different alternative asset classes, prove that a new asset class is well needed.

What is a Venture Builder?

A venture builder creates startups following a repeatable process and methodology. Unlike traditional venture capital firms that simply invest in existing startups, venture builders actively participate in the ideation, creation, development, and scaling of new companies, but with fewer companies. The venture builder model includes several distinctive elements:

- Internal Ideation: Generating business concepts internally based on market research and identified opportunities.

- Resource Sharing: Providing shared resources creating significant efficiency advantages.

- Hands-on Operational Support: In-house experts providing guidance in product development and scaling operations.

- Staged Funding: Providing initial capital with more favorable terms than traditional venture capital.

- Strategic Talent Deployment: Moving specialized expertise between portfolio companies as needed.

This approach industrializes the startup process, dramatically increasing success rates with more predictable outcomes.

Key Criteria for Selecting Venture Builders

Family offices should evaluate potential venture builder investments based on these critical factors:

1. Leadership by Seasoned Entrepreneurs: Look for proven track records of building and scaling companies.

2. Robust Support Infrastructure: Comprehensive teams across finance, HR, and marketing.

3. Access to Strong Technical Talent: Deep relationships with technical talent pools.

Proven Success in the Venture Builder Model

The venture builder approach has already produced category-defining successes:

• Hims & Hers Health: Telehealth solutions, valued at over $2.8 billion (NYSE: HIMS)

• Snowflake: Enterprise data storage, exceeding $58 billion market cap (NYSE: SNOW)

• Delivery Hero: Global food delivery built by Rocket Internet, valued at $9.2 billion (Frankfurt: DHER)

InVitro Capital: Leading the Venture Builder Revolution

Enter InVitro Capital. We blend the innovation-driven mindset of VC with the operational rigor of PE, delivering value through three core advantages:

1. Built for Profitability: Superior Returns with Reduced Dilution

By providing shared resources across our portfolio, we dramatically reduce overhead that would typically drain startup resources.

The financial impact is significant:

• Capital Efficiency: Startups achieve more with less funding, preserving equity

• Accelerated Path to Profitability: Shared resources shorten time to positive cash flow

• Stronger Equity Positions: Both investors and founders maintain larger ownership stakes

2. Enhanced Liquidity Opportunities Through Cash Flow Positive Entities

One of the most significant constraints in private market investing is illiquidity – capital locked away for 7+ years with uncertain outcomes. InVitro Capital addresses this challenge directly:

• Cash Flow Generation: Companies built for early profitability can distribute returns by the 4th year.

• Strategic Exit Optionality: Profitable companies attract diverse exit opportunities.

• Reduced Dependency on Market Timing: Cash-flow positive companies can wait for optimal exit windows.

3. Building Scalable Organizations Through Sophisticated Technology

InVitro Capital deploys sophisticated, scalable technology platforms:

• Shared Tech Infrastructure: Enterprise-grade technology for early-stage companies

• Data-Driven Decision Making: Advanced analytics capabilities from day one

• Accelerated Innovation Cycles: Reduced development timeframes through shared knowledge

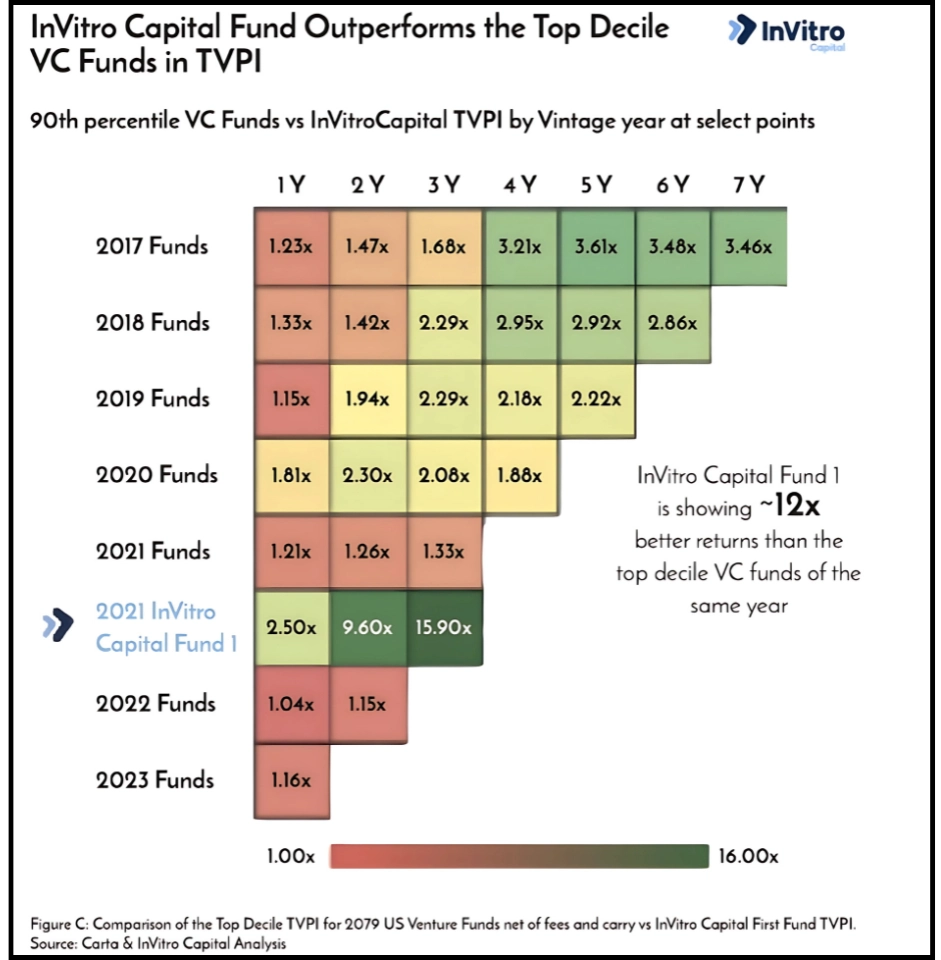

InVitro Capital’s first fund has a TVPI of 15.9x for their 2021 fund, compared to 1.33x in the best VC funds.

The Future of Private Market Investing

As family offices seek both strong returns and responsible stewardship of capital, venture builders are emerging as the premier asset class in private markets. While traditional VC operates on the “spray and pray” principle, venture builders create companies with intention and support them systematically. The future of startup investment isn’t just about placing bets – it’s about building companies deliberately and methodically. For family offices looking to balance innovation, returns, and risk management, venture builders offer a compelling new avenue for strategic capital deployment. That future is already being built inside venture studios, and forward-thinking family offices are taking notice.

Sources:

1. https://www.klarphos.com/news-insights/a-simple-case-for-alternative-investments-to-enhance-portfolio-returns

2. https://carta.com/data/recent-vc-fund-performance-q3-2024/

3. https://www.cbinsights.com/research/report/venture-trends-2024/?utm_campaign=newsletter_general_RU_hs

4. https://news.crunchbase.com/venture/what-does-it-take-to-raise-yournext-round-in-2018/

5. https://www.cbinsights.com/research/report/startup-failure-reasons-top

6. https://carta.com/uk/en/data/vc-fund-performance-q4-2024-full-report/