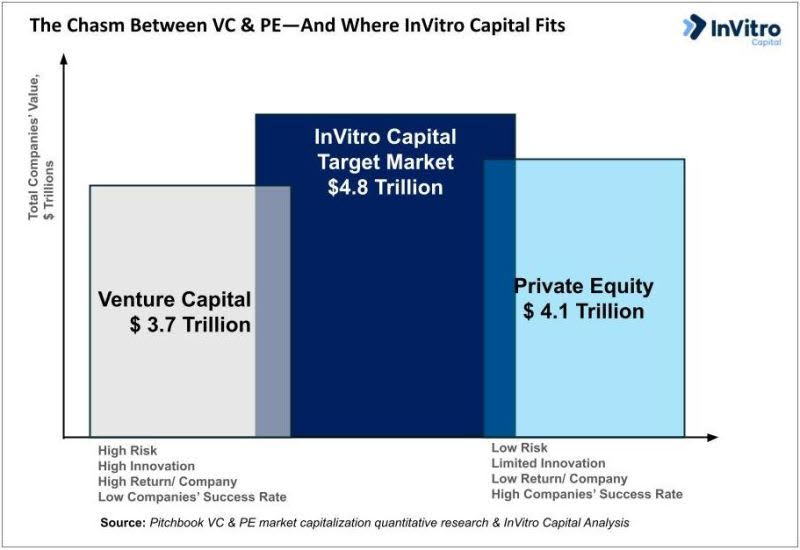

Venture Capital (VC) fuels early-stage disruptors, chasing unicorns and massive returns. On the other hand, Private Equity (PE) thrives on mature businesses, leveraging buyouts and optimization to enhance cash flow.

Both approaches have their strengths, but there’s a significant gap for companies seeking sustainable, profitable growth without burning through capital or banking on a single moonshot exit. These companies aim to deploy meaningful innovation and truly disrupt industries—but where do they turn?

In today’s investment landscape opportunities like foundational LLM models, AI infrastructure, biotech, and diagnostics align well with VC’s risk appetite. The potential rewards are high, though the journey is loaded with high failure rates and the need for extensive capital to back a handful of successful bets. Hence, multiple bets are a must.

However, for startups building AI software, AI agentic solutions, and similar technologies, the space can quickly become crowded. In such cases, execution excellence and capital efficiency are fundamental for success. The typical VC model for these startups often leads to excessive dilution, frustrated LPs and investors, and disheartened founders. This is where InVitro Capital steps in.

Enter InVitro Capital. We blend the innovation-driven mindset of VC with the operational rigor of PE, delivering value to founders and investors through:

– Hands-On Support: Embedded expert teams in product development, marketing, and finance from day one.

– Capital Efficiency: Prioritizing viable unit economics early, steering clear of the “grow-at-any-cost” approach.

– Flexible, Quicker Exits: Targeting mid-market exits ($50M–$200M) or strategic scaling, offering alternatives to the all-or-nothing success model.

– Curated Portfolio: A focused selection of ventures, each with a higher likelihood of sustainable success.

Our approach bridges the chasm between VC and PE, offering the best of both worlds: innovation with discipline, and growth with profitability.

CLICK HERE To get exclusive insights, updates, and announcements straight from InVitro Capital.